How popular are the outdoors? What outdoor industry trends are the most common? What and how do outdoor consumers prefer to buy and what is their purchasing decision based on?

The Outdoor Consumer Report 2021 by ISPO and Deloitte answers these and many other questions. The major study on the European outdoor industry is available for free download. In addition, the Outdoor Consumer Report 2021 will be presented as part of the Sports Retail Study at ISPO Munich 2022.

For the Outdoor Consumer Report 2021, a total of 9,500 people from 19 European countries were asked about their outdoor activities and consumer behavior in a representative survey focussing on age and gender in August and September 2021.

Hiking, running and cycling most popular

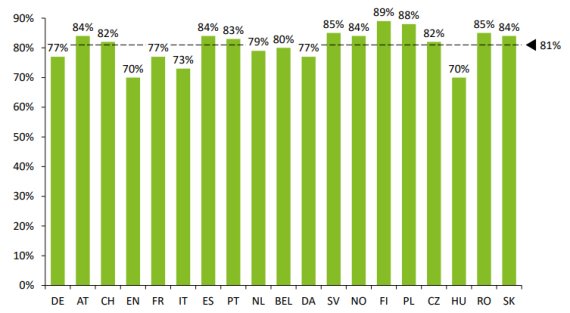

It is clear that outdoor activities are a mass phenomenon in Europe. 81 percent of those surveyed stated that they have done an outdoor activity in the past twelve months.

There are significant differences in the frequency of these activities. While respondents go running relatively regularly - almost 50% of runners answered "several times a week" - only just under a quarter of hikers go on hikes several times a week.

"The pandemic has had a mixed impact on the outdoor industry. Considering the market as a whole, many activities have gained popularity because people suddenly had to adjust to the lockdown situation," says ISPO Senior Associate and Consultant Hans Overduin in an interview as part of the Outdoor Consumer Report 2021: "This lead many to discover activities they could do outside as their regular go-to locations such as bars and gyms were closed in many countries across Europe."

Run on outdoor products - also for everyday use

55% of respondents have bought at least one outdoor product in the past twelve months. Almost half of these (46%) said they also use their outdoor product in normal everyday life. In the coming twelve months, 48% intend to buy at least one outdoor product.

Retail continues to be popular with outdoor customers

Striking outdoor retail industry trends: Two thirds of outdoor customers prefer to buy their outdoor products offline in local stores. The most important reason given by those surveyed was the opportunity to try on and try out products on site.

"A retailer which presents a curated assortment driven by passion, authenticity and quality, sold by motivated and competent sales personnel will be successful," says Tim Wahnel, Head of Division Outdoor Sport 2000, in an interview as part of the Outdoor Consumer Report 2021.

Sustainability goes down well with customers

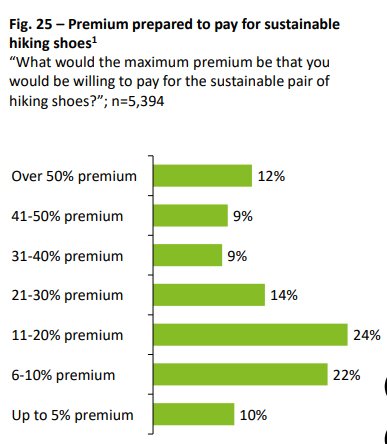

The megatrend of sustainability also plays a role in the purchase decision itself: 87% of respondents take sustainability criteria into account when buying outdoor products. 57% are willing to pay a higher price for sustainable products.

Digitalization: Outdoor and technology continue to merge

The SportsTech megatrend has also long since arrived in outdoor activities: 78% of those surveyed use technological aids for their outdoor activities, from smartphones to avalanche search devices. The use of apps for outdoor activities (53%) and online outdoor communities (40%) is also widespread.

Based on Google Play Store rankings (July 2021), the most popular apps for outdoor activities are Alltrails, Komoot, MapMyWalk and Strava.

More dynamism again in Europe's outdoor industry

In the European outdoor recreation industry, the Outdoor Consumer Report 2021 has noted more movement in the area of M&A (mergers and acquisitions) in recent months. After fewer such transactions took place in 2019 and 2020 - the report records only seven M&A agreements for the European industry in 2020 - there were already more in the first seven months of 2021 with 15 M&A deals than in the entire previous year.

The share prices of European outdoor brands have also now largely recovered from the pandemic shock of early 2020. The biggest winner on the stock market among the outdoor companies surveyed was Yeti Holdings Inc. with a value increase of around 180% since January 2020.

Outdoor Consumer Report 2021 download free

In addition to many other insights into outdoor industry news, the Outdoor Consumer Report 2021 also sheds light on the recent increase in M&A activities in the industry. In addition, Tim Wahnel, Head of Division Outdoor Sport 2000, ISPO Senior Associate and Consultant Hans Overduin as well as the Ternua Group provide valuable business insights and outlooks on the trends in outdoor industry in transition in exclusive interviews.

The Outdoor Consumer Report 2021 is available for download here.

OutDoor by ISPOOutDoor in transition

OutDoor by ISPOOutDoor in transition

- Awards

- Mountain sports

- Bike

- Fitness

- Health

- ISPO Munich

- Running

- Brands

- Sustainability

- Olympia

- OutDoor

- Promotion

- Sports Business

- Textrends

- Triathlon

- Water sports

- Winter sports

- eSports

- SportsTech

- OutDoor by ISPO

- Heroes

- Transformation

- Sport Fashion

- Urban Culture

- Challenges of a CEO

- Trade fairs

- Sports

- Find the Balance

- Product reviews

- Newsletter Exclusive Area

- Magazine