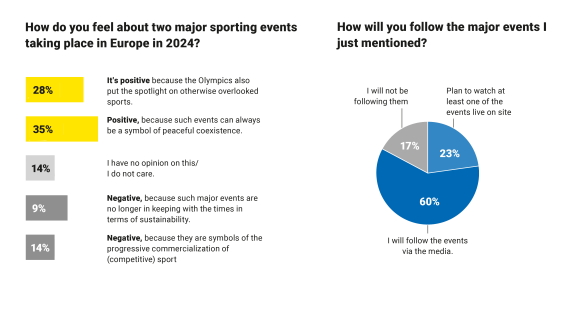

Major events do not automatically boost sales of sportswear - as shown by the controversial soccer World Cup in Qatar and the Winter Olympics in China. However, the two mega events of the 2024 sporting year, the UEFA EURO in Germany and the Olympic Games in Paris, France, are far more promising.

As an ISPO Business Member you get free access to the current ISPO Consumer Insights Report Q4/2023.

All you have to do is click on the link and download the report.

Fact 1: The infrastructure is already in place and there are no critical construction projects being rushed through by autocratic governments.

Fact 2: In times of many conflicts and wars, the Olympic idea of a peaceful, sporting competition is even more relevant and important.

Further facts: Niche sports in particular benefit from the increased attention of international events. This brings brands and outfitters from the "Teamsports & Spirit" sector to the attention of consumers. Showing presence can be a game changer: This can be achieved through official sponsorships on the one hand and creative campaigns for the respective events on the other. Brands whose athletes compete at the Olympics, for example, are therefore very popular.

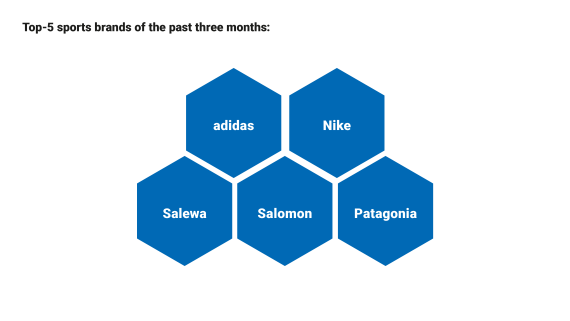

The big learning in "Teamsport & Spirit" is that sponsoring and equipping top athletes continues to pay off - even for less popular sports. Overall, the two major European sporting events in particular are casting their shadows ahead: Adidas is very high in buyers' favor over the next three months. Nike will also be in high demand - the two brands dominate the field almost single-handedly. Puma and Asics are also in the running.

Even though sponsorship and events are perfect for giving athletes and other communication ideas a stage, they are only two building blocks for successfully positioning brands and products. We all know that it's the mix that wins. A high level of credibility is fundamentally important. Working with cool athletes and social commitment seems to be a recipe for success.

A surprising result of the current ISPO Consumer Insights Report Q4/2023 is that collaboration with influencers has almost no direct influence on the credibility of the brand - at least not with a very top and sports-savvy target group. However, anyone thinking about removing all influencers from their marketing and sponsorship mix now needs to be careful.

Social media stars can still be an important part of a brand's communication strategy because they have reach in a relevant target group. At the same time, influencers can also do things that athletes may not be able to do - for example, support direct sales and sales or accompany product launches in the media.

As a result, influencers are more important for product communication than for brand communication. Marketing experts should keep this in mind for their go-to-market strategy.

The two megabrands Adidas and Nike are doing really well with their marketing mix: they are still at the top. Adidas in particular is helped by the high acceptance of its functional outdoor line Terrex and is scoring points in the healthstyle megatrend. Runamics can call itself an up-and-coming newcomer here.

Patagonia also continues to receive top marks from customers. The company's sustainability commitment to more sustainable shopping, repair services and protecting the oceans is well received. Picture Organic Clothing has the potential to become a similar love brand. For example, the B-Corp certified clothing manufacturer uses its own fabric waste for new items and offers a rental service for its sustainably produced jackets and pants.

Salewa, Salomon, Mammut and Ortovox have continuously developed into the most popular brands in the community in recent months. They are not only reliable companions for all outdoor activities, but also inspire their customers with fashionable, casual urban outdoor collections. VF can also call itself a high potential in the field of urban culture. With The North Face and Vans, the company is very well positioned. Adidas and Nike are at the forefront here. Also well represented: Patagonia.

In the "Digital & Connectivity" megatrend, Garmin leads the group unchallenged, but the absolute winner here is Wahoo. The fitness technology company has made great leaps towards the high-potential group. Coros emerges as a newcomer. The Chinese performance sports wearables manufacturer can look forward to increasing purchase intentions.

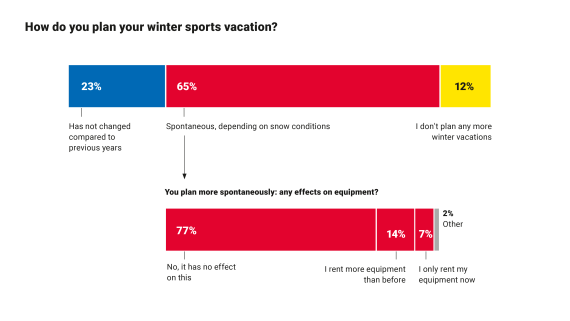

Finally, a look at winter ... The current ISPO Consumer Insights Report Q4/2023 shows one thing very clearly: the traditional and firmly established winter vacation will soon be a thing of the past. But there is also good news: powder fun is still very popular - but winter sports enthusiasts will be planning more spontaneously in the future.

The rental market is likely to continue to be a major beneficiary of this trend. Our trend barometer from the second quarter of 2023 has already shown that consumers now want to rent more goods than the hardware classics of skis, snowboards, bikes or surfboards. Whether jackets or pants - renting is becoming increasingly hip. For tourism destinations, this means offering alternatives in the event of poor snow conditions in order to better plan sales and capacities. A good example of this is the Austrian region of Ötztal, which offers Area 47, an outdoor leisure park including an indoor bike park.

You want to become a panel partner of the trend barometer with your brand and ask your own questions to the consumer experts? Become an exclusive panel partner of the quarterly report with your brand as an ISPO Business Member. We will be happy to advise you.

Sports BusinessSki Mountaineering Goes Olympic: What Milano-Cortina 2026 Means

Sports BusinessSki Mountaineering Goes Olympic: What Milano-Cortina 2026 Means

- ISPO awards

- Mountain sports

- Bike

- Design

- Retail

- Fitness

- Health

- ISPO Job Market

- ISPO Munich

- ISPO Shanghai

- Running

- Brands

- Sustainability

- Olympia

- OutDoor

- Promotion

- Sports Business

- ISPO Textrends

- Triathlon

- Water sports

- Winter sports

- eSports

- SportsTech

- OutDoor by ISPO

- Heroes

- Transformation

- Sport Fashion

- Urban Culture

- Challenges of a CEO

- Trade fairs

- Sports

- Find the Balance

- Product reviews

- Newsletter Exclusive Area

- Magazine