When looking at the top rankings of the brands, the question remains as to what would actually persuade opinion-forming end consumers to switch. Two trends can be identified in this regard in the current Consumer Insights Report - this time in cooperation with Alibaba.com.

As an ISPO Business Member you get free access to the latest Consumer Insights Report.

All you have to do is click on the link and download the report.

Trend 1: The three most important motivations for a purchase: climate-friendly, fair and social production. It also fits in with the fact that renting sports equipment is becoming increasingly hip. In addition to the classics such as ski hardware, bicycles and surf equipment, there is now new potential, such as tents and fitness equipment; Peloton and Vaha, among others, should be mentioned here.

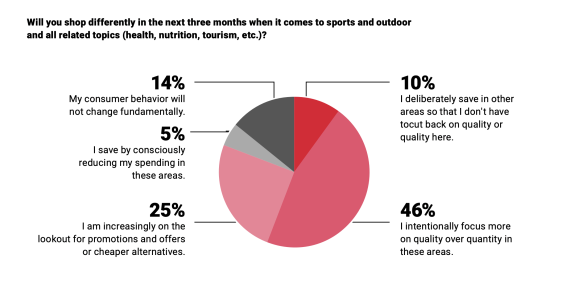

Trend 2: The new buzzword is quality. The main criterion for purchasing is not the price, but an expected longevity of the products in order to avoid new purchases. Only in second place does price sensitivity come into play. Read the conclusion for the sports industry in the current Consumer Insights Report.

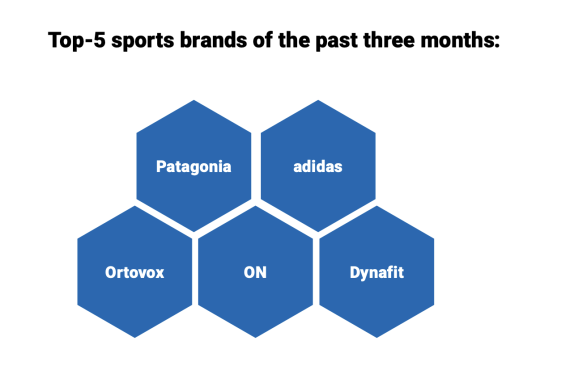

In the truest sense of the word, there is currently a lot of movement in the rankings of the top brands. Founder Yvon Chouinard is giving his company away to the earth, and in addition to media attention, Patagonia is also getting top marks from customers. In the latest Consumer Insights Report, the outdoor brand is clearly in the lead. Adidas, Ortovox, On and Dynafit also perform in the top group. But this report also proves one thing: that size and market power do not necessarily have anything to do with brand perception.

Absolutely worth mentioning is Decathlon's entry into the chasing pack with brands such as Salomon, Nike and Mammut. This amounts to a bit of a market shakeup, as the discounter is sometimes very controversial among sports retailers in the industry. And in the second chasing group, Hoka One One continues its success and would certainly like to pass Deuter, Salewa and The North Face.

Whether hiking alone in the mountains, or feeling part of an online community, or playing a team sport: a sporty lifestyle is becoming increasingly important across all target groups. The best conditions, then, for sports brands of all stripes.

Patagonia can look forward to many new buyers in the "urban culture" segment, and On is making the turnaround from a pure running brand to a lifestyle brand.

Little has changed in "Connected Athletics" - Garmin remains in the sights of new buyers. But Outdooractive's recent efforts seem to have paid off: The app provider is overtaking competitor Komoot.

In the "Team Sport & Spirit" segment, Adidas and Puma are currently enjoying a tailwind - fueled, of course, by the(controversial) soccer World Cup in Qatar.

New in the "Adrenaline & Adventure" field is the Red Bull brand, which now has more than just its energy drink in its portfolio.

On the other hand, the development in the "Nature Escapes" lifestyle is exciting. Despite the enormous attention paid to Patagonia, Ortovox has managed to be on a par with the US giant. The approaching winter is shaking up the ranking a bit here.

An increase in purchase intent can also be seen in "Performance, Body & Mind" - especially in the nutritional and dietary supplements sector: Powerbar, Clifbar and Orthomol are on the rise.

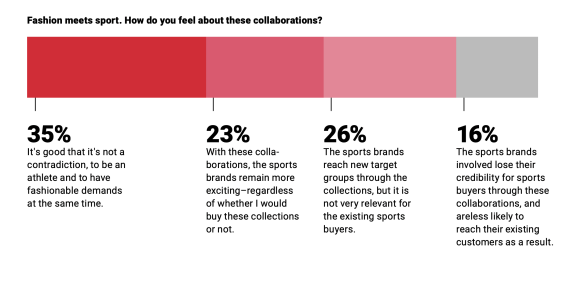

The latest Consumer Insights Report also looked at the impact of brand collaborations. Does the collaboration with Gucci harm The North Face, for example? Clear answer: No. In summary, the majority of the existing target group finds it exciting when the trusted sports brand reinvents itself and helps to make a fashion statement as well. And at the same time, brands can reach new target groups. However: caution is advised...

Do you want to become a panel partner of the trend barometer with your brand and ask your own questions to the consumer experts? Become an ISPO Business Member with your brand and become an exclusive panel partner of the quarterly report. We will be happy to advise you.

- ISPO awards

- Mountain sports

- Bike

- Design

- Retail

- Fitness

- Health

- ISPO Job Market

- ISPO Munich

- ISPO Shanghai

- Running

- Brands

- Sustainability

- Olympia

- OutDoor

- Promotion

- Sports Business

- ISPO Textrends

- Triathlon

- Water sports

- Winter sports

- eSports

- SportsTech

- OutDoor by ISPO

- Heroes

- Transformation

- Sport Fashion

- Urban Culture

- Challenges of a CEO

- Trade fairs

- Sports

- Find the Balance

- Product reviews

- Newsletter Exclusive Area

- Magazine