Under the direction of Arne Strate, Secretary General of the EOG, the following participants discussed the future of the outdoor sports industry in a workshop within the ISPO Re.Start Days

- Peter Ottervanger (Head of Retail/ European Outdoor Group)

- Pauline Shepard (Head of Market Research/ European Outdoor Group)

- Scott Nelson (Programme Manager/ European Outdoor Group)

- Pippa Goodman (Client Partner/Foresight Factory)

- Moderation: Arne Strate (Secretary General/ European Outdoor Group)

The main question on the agenda came as no surprise: How has Covid-19 affected people's enthusiasm for sport and the outdoor industry? In keeping with the ISPO Re.Start Days, this was of course coupled with the follow-up question: How can we make a fresh start?

Retailers were severely affected by the outbreak of the virus and had to close their stores as part of the measures to contain the coronavirus. However, consumers were also severely restricted in the practice of their respective sports. While there were lighter restrictions in the countries of the DACH region and outdoor sports alone were still possible, outdoor athletes from countries with a complete curfew, such as Spain and Italy, were no longer able to practice their sports.

This is also reflected in the figures: To determine the impact on consumers in the outdoor industry, 1,000 participants each from the UK, France, Germany, Spain, Italy, Poland and Sweden were surveyed.

88 percent of those surveyed said that they do sport at least once a week, 61 percent of them mainly outdoors. And sport is very important to them: 58 percent said they missed outdoor activities most during the restrictions and 70 percent plan to do more outdoor sports after the restrictions are lifted. However, with caution: 78 percent want to pay attention to reduced contact with others during sports.

Health remains a key driver for physical activity: 87 percent believe that outdoor sports improve physical well-being. For mental well-being, the proportion is even slightly higher at 88 percent.

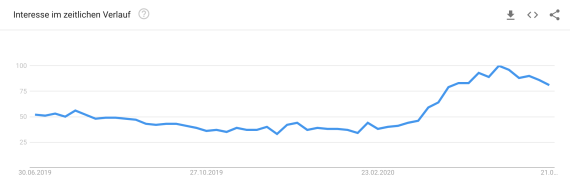

Walking and running are still the most popular outdoor activities, closely followed by cycling. At the same time, the popularity of these sports continues to grow. The outlook for the market is also optimistic, as can be seen from the Google trends: During the restrictions, interest in the search term "best bikes" has almost doubled worldwide compared to the previous year.

According to Pippa Goodman, client partner of Foresight Factory, there is currently a whole new appreciation for outdoor activities. At the same time, there is a strong incentive to go outside.

These incentives are very diverse and can be roughly divided into four categories:

- Fit and healthy: 21 percent of the respondents take exercise outside to improve their health and fitness.

- Mental matters: 30 percent move their sporting activity outdoors to relax, reduce stress or spend time in nature.

- easy entertainment: 11 percent look for entertainment outside, for example through social contacts with training partners.

- Experience first: The largest part, 38 percent, are looking for an experience or adventure in outdoor sports. Younger people in particular have this incentive.

Health reasons are somewhat more prevalent among older people.

The conclusions for retail are therefore obvious. There must be a focus on people's needs. Health and the increase of physical resilience are at the forefront here. However, outdoor activity also makes a major contribution to people's general well-being. Apparent reasons that speak against outdoor activities can easily be eliminated and can be overcome.

In essence, it is a matter of taking into account the different motivations, obstacles and needs of different age groups, life situations and individuals (necessary for tailored targeting)

Peter Ottervanger, Head of Retail of the EOG, also clarifies the role of sustainability for the outdoor industry in the workshop: "Sustainability is essential for future business in any company."

This is one of the reasons why the EOG decided to introduce the "Single Use Plastic Project", in which 35 brands and retailers of the outdoor industry have been working together since 2018 to reduce the negative effects of disposable and disposable plastic.

After all, with an average of 4.88 million poly plastic bags per organization per year, the impact on nature can be enormous if handled incorrectly.

The reputation of plastic is negative. The main reason is obvious again: the pollution of the environment and the pollution of the oceans through incorrect disposal. But appearances are deceptive. Scott Nelson, Programme Manager of the EOG, currently sees plastic as the best material option for packaging. The reasons for this is recycling, according to the project manager of the Single Use Plastic Project.

The controversial material is better for the environment during the production process, transport and use than the other options. Cotton bags, for example, cause a 7100 times greater environmental impact than LDPE bags that are reused. The only major disadvantage of the material is the disposal at the end of its life cycle.

Recycling is also proving difficult for both businesses and consumers. The many different types of plastics and colours often make further processing to a usable end result extremely complicated or impossible. As a result, large quantities of recycled plastic end up in environmentally unfriendly disposal.

Scott Nelson sees the solution to the problem in a special recycling cycle for brands and retailers, which makes it possible to recycle the resulting plastic packaging. This would not be possible for a single brand or retailer due to the small quantities involved, but a merger could circumvent this obstacle. In this way, 86 percent of the plastic can be reused instead of being incinerated, buried or otherwise disposed of in an environmentally harmful way.

The EOG is already implementing this concept with the 35 participating members. Brands and retailers that are not members of the European Outdoor Group itself are also eligible to participate. Further information on participation is available from the EOG.

Sports BusinessSki Mountaineering Goes Olympic: What Milano-Cortina 2026 Means

Sports BusinessSki Mountaineering Goes Olympic: What Milano-Cortina 2026 Means

- ISPO awards

- Mountain sports

- Bike

- Design

- Retail

- Fitness

- Health

- ISPO Job Market

- ISPO Munich

- ISPO Shanghai

- Running

- Brands

- Sustainability

- Olympia

- OutDoor

- Promotion

- Sports Business

- ISPO Textrends

- Triathlon

- Water sports

- Winter sports

- eSports

- SportsTech

- OutDoor by ISPO

- Heroes

- Transformation

- Sport Fashion

- Urban Culture

- Challenges of a CEO

- Trade fairs

- Sports

- Find the Balance

- Product reviews

- Newsletter Exclusive Area

- Magazine